| Topic: Making 40 Grand a Year On Welfare! | |

|---|---|

|

Edited by

Lpdon

on

Wed 07/16/14 01:05 AM

|

|

|

With 11 children and 11 grandchildren, life for Katerina Sisarova, 43, from Slovakia, used to be a struggle to make ends meet. But seven years after moving to Rotherham in Yorkshire, Mrs Sisarova says life is 'very nice'� and it's all down to the $40,000 USD she receives from the taxpayer annually.

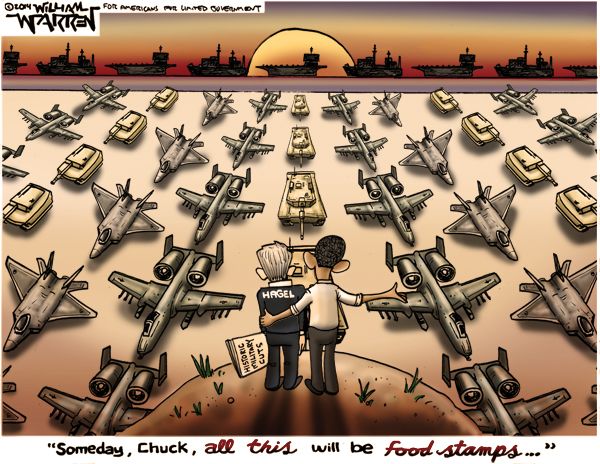

What's more, Mrs Sisarova, who has worked for a grand total of one month in seven years, says she has no plans to find work and spends her time caring for her grandchildren instead. And she isn't the only one. Although husband Peter, a builder by trade, has had the odd job, he hasn'�t worked for two years while all but one of Mrs Sisarovas 11 children are unemployed and living on benefits. My country no have job, no food nothing, adds her husband. No. I'�m not going back no, not ever. I like it here in England. England give me house, give me doctor, school, benefit. England good. Thank you so much England. Thank you very much. I get child benefit, tax credit, housing benefit,�� she says happily. I've got a better life here than in my country. I'm never going to go back to Slovakia, never. Unfortunately for Mrs Sisarova, her reluctance to find work hasn’t gone unnoticed by the job centre, which has threatened to cut her benefits – much to her fury. ��It's not fair to suspend money like this, she fumes. Is it right to do that? No! Every time I go to sign on, they come up with something all the time. I am so cross! So cross!’ In Rotherham, much of the development work involves helping newcomers to settle in, which as translator Mikel explains, often means helping them claim benefits. ��Katerina comes here quite often, he explains. ‘We try to help her with making phonecalls or filling in forms.�� He adds: ‘She has been suspended a few times from the JSA [jobseekers allowance] payments and the reason is that she is not actively looking for a job. So why the UK and why Rotherham? According to Mikel, benefits are a huge draw. ‘Because the UK is in the EU, we [Roma] can work or claim benefits. ‘The UK is a welcoming country, an easy country to be in. I think it’s easier to claim benefits here than in our countries, so if we have people in here, we help them to claim benefits. Then there are other Roma who may be abusing the system. And don’t get me wrong, there are some of the British people who could say “they don’t do nothing” and stuff like that. Among them is Mrs. Sisarova, who, thanks to Mikel’s efforts on her behalf, has managed to evade having her benefits cut once more. ��She will get paid job seekers allowance of �500 a month, beams daughter Petra. ‘Very nice!’ adds her delighted mother. Daughter Petra, 20, lives in a council house nearby with her son Peter, three, and also lives on handouts, which in her case, total �650 a month. http://www.rightwingnews.com/uncategorized/immigrant-welfare-mom-says-life-is-very-nice-on-welfare-and-she-doesnt-want-to-leave-or-go-home/ No wonder their system is broken and this is what Fuhrer Obama wants to see happen here ASAP. |

|

|

|

|

|

i agree it is all wrong . i am a pensioner and live on �122-00 per week with a private pension of �29-00 and i get stopped �9-00 tax on that . discusting i say !!!

|

|

|

|

|

|

I have gone to the UK, its NOT easy to get in, they aren't welcoming,,,,from my experience

obviously, others have a different experience this seems like one person abusing their system, which is quite different than ours,,and which I have not heard any plans to emulate by the US , its government, or its POTUS. |

|

|

|

|

|

I have gone to the UK, its NOT easy to get in, they aren't welcoming,,,,from my experience obviously, others have a different experience this seems like one person abusing their system, which is quite different than ours,,and which I have not heard any plans to emulate by the US , its government, or its POTUS. MH, once again, just because you are ignorant of a subject, does not mean the subject does not exist ... An article (one of many) in Forbes ... "Obama Has Nearly Achieved His European Welfare State The debt-ceiling brouhaha diverts attention from the most fundamental economic issue we face: Do we want a European-style welfare state? If we do, how in the world are we going to pay for it? Presidential candidate Barack Obama called for “hope and change,” but he was deliberately vague on the “fundamental change” part. In speeches as president both at home and abroad, he appeared to reject American exceptionalism and intimated we have much to learn from Europe, especially its cradle-to-grave welfare state. Obama’s juggernaut passage of universal health care, despite severe budget and employment problems and the loss of his Senate super majority, bears witness to his determination to transform the United States into something more closely resembling Europe. Although many regard his term in office as a failure, he has nearly achieved his long-term objective. He has completed the foundation of the Europeanization of the American economy. The European welfare state requires huge levels of public spending and taxation. Public spending in France, Italy and Sweden is more than 50% of GDP. Frugal Germany provides the lower bound at a “modest” 48%. Some of this public spending goes to the unfortunate, but the bulk goes to the middle class for retirement and health benefits. The pillars of the European welfare state are state retirement (often at relatively young ages), universal state health care, and entitlements for poverty and unemployment that are virtually unrestricted by calendar limits. With the passage of Obama Care, we now have in place the two most important of the three elements of the European welfare state: Social Security and Medicare and Medicaid as expanded by Obamacare. The missing element is unemployment and poverty insurance virtually uncapped by maximum periods of coverage (Aid to Families with Dependent Children was limited to five years in 1993). The fifty percent or more share of state spending in Europe is financed by conventional income and profits taxes, VAT taxes (ranging from 15% to 20%), and payroll taxes approximately twice U.S. social security rates. High payroll taxes have been an integral part of the European experience for a long time. In the U.S. payroll taxes were introduced in 1935 and remain low by European standards. In other words, we have created a European-style welfare state without the means of financing it. Therein lies the rub. This hard fact is seen in the trillions of dollars of unfunded liabilities of Social Security and Medicare, which we conveniently ignore in budget debates. With our current tax system, we simply cannot pay what our citizens have been promised. Consider the magnitude of our funding shortfall: On the eve of Obama’s inauguration, federal, state and local revenue equaled 32.5% of GDP. With the extended economic slump starting in 2007, total government revenue fell to 29%. During our last year of prosperity, 2006, it equaled 35%. If a European-style welfare state requires 50% of GDP, we are currently 20 percentage points short. Applied to current GDP, we are $3 trillion short! We must ask: Where is the $3 trillion to come from? Obama has repeatedly employed class-warfare rhetoric to claim that we can afford everything if the rich pay their “fair share.” Such posturing reflects stupidity or mendacity, more likely the latter. If we taxed away half the income of those earning $250,000 and above, we would raise at the very most $700 billion of the $3 trillion shortfall. Treasury coffers would receive much less as the “rich” adjust their economic behavior. Forcing the rich to “pay their fare share” would make no difference whatsoever. The President’s non-strategy of “soak the rich and then just keep going deeper into the red” is not an alternative, and he and his advisors know it. The fact that the full faith and credit of the federal government is currently under question is more than adequate proof. The Obama administration has also followed past administrations in pushing rosy cost scenarios. We should judge claims that ObamaCare will save money in the context of the optimistic cost assumptions of past entitlements. Actuaries underestimated the cost of Medicare by a factor of ten in 1967 and the cost of Medicaid HSP by a factor of twenty in 1987. The “rosy” estimates of “under a trillion” cited during the health care debate will prove to be a gross underestimate. The harm of the miscalculation will be greater in this case. We are talking about errors of trillions not billions. There is no reason to believe that we can operate the welfare state on the cheap relative to Europe. Therefore the magic 50% or above figure holds for us as well. We can pay for a European-style welfare state only with new taxes that fall on everyone. Brief glimpses of this bitter pill seeped through the Obama campaign, but loose talk of higher taxes was quickly silenced. The Obama camp knew that even hints of new middle-class taxes would sink the campaign. Let us consider the options Obama has to finance a European-style welfare state: Option 1: Let all the Bush tax cuts expire Simply by taking no action in 2012, Obama could let the Bush tax cuts expire. It is a well kept secret that the Bush tax cuts favored the middle class more than the rich. Therefore their expiration would particularly hit the middle class. It would also return many of the “poor” to the tax rolls. If we use CBO analysis of full expiration of the Bush tax cuts, federal revenues would rise by about eight percentage points of GDP. The actual revenue gains would be much less (if anything) as people adjust their behavior to the new and higher taxes. Importantly, Obama’s unequivocal pledge of no tax increases for the middle class appears to rule out this option. In his April 10, 2010, Weekly Radio Address, Obama boasted that he had kept his campaign pledge: “And one thing we have not done is raise income taxes on families making less than $250,000. That’s another promise we’ve kept.” Obama’s base would not tolerate a tax increase on the middle class or the poor. Option 2: Doubling social security tax rates Europe pays for the bulk of its welfare state with extremely high social security taxes, in most cases double our current rates. With an unemployment rate above nine percent and little prospect of sharp improvement, Obama could muster no support whatsoever for raising social security taxes, other than to raise the taxable-income limit. We lack the option of financing our welfare state through taxes on labor as it is done in Europe. Option 3: VAT taxes Europe supplements its high taxes on labor with a 15-20 percent value added tax on the production of goods and services at each stage of production. The VAT can be conveniently initiated as a “small” 1% to 3% tax, which then grows over time, hopefully unnoticed. Trial balloons of a value-added tax were floated during Obama’s election campaign and quickly burst. But if Europe is Obama’s model and given the lack of other options, why not? It is notable that Obama crafted very nuanced language to keep a VAT in play. In his original tax pledge, he promised that no family making less than $250,000 would see “any form of tax increase.” In a later speech on April 15, 2010, Obama notably changed his earlier formulation: “And one thing we haven’t done is raise income taxes on families making less than $250,000 a year — another promise that we kept.” But when asked on April 21, 2010 about a VAT, the president said: “I know that there’s been a lot of talk around town lately about the value-added tax. That is something that has worked for some countries. It’s something that would be novel for the United States. And before, you know, I start saying ‘this makes sense or that makes sense,’ I want to get a better picture of what our options are.” In other words, the VAT is on the table, but with the election approaching it is not a good time to talk about it. If Obama is reelected, he will either push for a VAT, or leave his successor with an incredible fiscal mess. With no other options, a VAT that eventually reaches European averages is a must to reach the fifty percent threshold for a European-style welfare state. Unfortunately for Obama’s base, the VAT is most likely a regressive tax. Option 4: Gas Taxes The Obama administration has one final tax option: A steep federal gas tax justified by the noble aim of promoting green energy. (The failure of his carbon tax in Congress seems to rule out that option.) The gas tax need not even be couched as a revenue enhancing measure. There could even be talk of devoting its proceeds to green technology, but these promises could be forgotten as gas-tax revenues disappear into general revenues. If Obama were to use taxes to boost U.S. gas prices to European levels, he could raise about a half trillion in new revenues each year, which would raise the government share another three percent. Such a gas tax, however, would lower average standards of living by 10% to 15% as household budgets are strained. Its political toxicity could perhaps be countered by “saving the planet” rhetoric. A second-term Obama, however, would be hard pressed to get it through any Congress. The election of 2012 will determine whether Obama will achieve his goal of creating a European-style welfare state in the United States. The 2010 election probably deprived him of the option of pushing through new taxes. But, even if he is not reelected, it is unclear whether a new Republican administration can undo Obamacare. Once entitlements are on the books, it is almost impossible to get rid of them even after their unbearable costs are apparent. Obama’s Republican successor is left holding the bag. We have promised a welfare state that we cannot afford. These alarming figures explain the Tea Party movement, whose motto is “it’s the spending stupid.” It explains the vociferous opposition to the new health care entitlement. It also shows the crucial role of the Republican house freshmen in holding the line on spending. I often hear the refrain: “So what if we have a European style welfare state? Life in Europe is just fine.” Nobel laureate Robert Lucas, in a recent lecture delivered at the University of Washington, calculated that the European welfare state lowered standards of living some thirty percent by distorting economic decision making, inhibiting innovation and entrepreneurship, destroying labor motivation, and creating permanent unemployment. This is the price Europeans pay for their “quiet life.” We must decide as a nation whether we are prepared to pay the same price. Paul Roderick Gregory is a Hoover Institution research fellow." |

|

|

|

|

|

Edited by

msharmony

on

Wed 07/16/14 04:36 AM

|

|

|

well, that was alot of interesting information that included NOTHING to refute my statement

I have gone to the UK(Undisputed) it was not EASY to get in, they werent welcoming(Undisputed) obviously others have a different experience(undisputed, and contrary to the incorrect comprehension that I somehow stated something 'didnt exist') this seems like one person abusing the system(undisputed) which is quite different than ours(differences which are actually highlighted in the attempt to disparage my statement) and which I have not HEARD any plans to emulate by the US, its government, or its POTUS (this is contested only by passage of healthcare reform, which is not actually like the UK because it is not UNIVERSAL HEALTHCARE) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|